TRENTON, N.J. (AP) — Called "biosimilars," they are near-copies of complex and expensive biologic drugs to treat cancer, rare diseases and autoimmune disorders like rheumatoid arthritis and colitis.

But U.S. sales have been so limited that their future is in doubt. Already, one company has scrappednearly all its biosimilar development projects.

Worst-case scenario? Drugmakers could abandon biosimilar development, and makers of original biologic drugs could keep raising their six-figure-a-year prices indefinitely.

Two years ago, the independent policy research group RAND Health predicted biosimilars would save the U.S. roughly $54 billion from 2017 through 2026. That's looking optimistic.

"This is a make-or-break period," said Dr. Scott Gottlieb, who led the Food and Drug Administration until April. "My fear is that some of the biosimilar-makers ... will say, 'We'll just go back to doing other things,'" and other drugmakers won't enter the niche.

Leigh Purvis, AARP's director of health services research, says the original biologic drugmakers "could kill this market before it ever takes off, and we desperately need it."

THE PROMISE

Biosimilars are akin to generic drugs, but true generics aren't possible with biologic drugs.

Pills are easily duplicated by mixing chemicals. Getting a generic version of a brand-name pill approved requires spending about $2 million and two years to conduct lab tests and show it's chemically equivalent to the original medication. Manufacturing costs just pennies a pill.

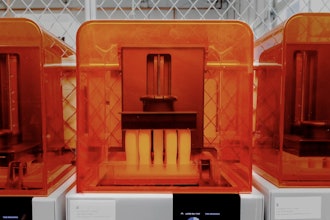

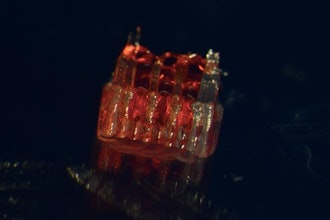

Biologic drugs, on the other hand, are made by manipulating living cells to produce a specific protein. They treat disorders often caused by faulty genes or immune systems, and they must be injected or delivered by infusion.

The complex process needed to grow and purify the proteins means a copycat biosimilar will never be identical to the original drug. But it also can't have "clinically meaningful" differences. Getting approval can take five to nine years of lab and patient testing, and cost over $100 million.

A decade ago, Congress passed a law meant to encourage development of cheaper biosimilars. But the makers of the original biologic drugs have fought hard to block the new rivals, with stacks of successive patents, lawsuits and rebates to insurers.

The result? Even drugmakers with the expertise and resources to produce biosimilars are mostly thwarted.

In the U.S., that is.

In Europe, monopoly-protecting patents generally don't last as long as in the U.S. and government-run health systems have favored biosimilars in exchange for steep discounts.

Biosimilars hit Europe in 2006. Now 54 are available at discounts up to 80 percent.

In the U.S., the FDA has approved 24 biosimilars, nearly all since 2015. Just 11 of them are actually for sale, generally at 15% to 35% below the original drug's price. Those discounts are easily matched by original biologic makers who prefer insurers give them a smaller piece of the pie than nothing.

Biosimilars have been approved in the U.S. for five biologic best-sellers on the market as long as 22 years: Humira and Enbrel, for rheumatoid arthritis, psoriasis and other autoimmune disorders, and the cancer drugs Herceptin, Rituxan and Avastin. However, their biosimilars can't be sold in the U.S. due to litigation and multiple, monopoly-extending patents.

The brands have monthly list prices of over $5,000 to nearly $13,000. Health plans pay much less, but even well-insured patients must pay a big portion — or the full price until they cover their plan deductible.

HOW WE GOT HERE

Drugmakers have been harnessing scientific advances to create targeted biologic drugs, many for cancer and rare conditions without good treatments. Their executives predicted insurers wouldn't balk at high prices because the patient numbers aren't big.

But as more people took biologic drugs and companies increased prices 6% to 20% every year, insurers and middlemen called prescription benefit managers limited patients' access. They also set high copayments for many patients.

Biosimilars were seen as financial salvation. But given their limited sales to date, the FDA is trying to enable faster approval.

In May, it issued guidelines to enable biosimilar-makers to show their products are interchangeable with an original biologic drug. Pharmacies then could substitute a biosimilar for a brand-name biologic, as happens routinely with generic pills.

Cancer patient David Mitchell, who founded the advocacy group Patients for Affordable Drugs, says biologic drugmakers are exploiting the system, despite having at least 12 years of market exclusivity.

"We have patients who say, 'I've been taking this drug for 15 or 20 years and there's still no generic,'" Mitchell notes.

He says the group also hears frequently from patients on biologic drugs "who are struggling or can't afford them."

Chuck Pope, a former machinist from Derry, Pennsylvania, has had rheumatoid arthritis since 2005 and took Enbrel for seven years. He said it prevented flare-ups of the joint-destroying autoimmune disorder, enabling him to keep working long hours.

Then shoulder injuries forced him onto disability and cost Pope his employer's "excellent insurance." Pope said he can't afford the thousands of dollars Enbrel would cost him under his Medicare plan.

"My body's just totally disintegrating because of the RA," which causes irreversible damage, said Pope, 64. "Wouldn't it be more logical to lower the price and have more people on the drug?"

BIOSIMILAR BARRIERS

Last year, the U.S. spent $126 billion on biologic drugs, only 2% of it on biosimilars, according to the health data firm IQVIA.

Gottlieb, the recently departed FDA commissioner, blames the slow uptake partly on doctors hesitant to switch patients to unfamiliar alternatives. He also points to barriers erected by the companies behind name-brand biologic drugs.

Their tactics include disparaging biosimilars as inferior, luring patients with coupons subsidizing their copayments, getting successive patents to extend their monopolies, and giving rebates to insurance plans which cover their biologic drugs but exclude rival biosimilars.

A report released Wednesday by a biosimilars trade group estimated the U.S. health care system lost $7.6 billion in possible savings since 2015 due to patent walls delaying sales of approved biosimilars.

Health plans are reluctant to take up biosimilars, because that would instantly end their big rebates, Gottlieb said.

Such exclusionary contracts have stifled sales of Inflectra, Pfizer's biosimilar of Johnson & Johnson's $5 billion-a-year autoimmune disorder drug, Remicade. Since launching in November 2016, Inflectra's U.S. sales totaled $438 million, though it's priced 25% below Remicade's $2,335-per-month list price.

Pfizer is suing J&J for "unlawful conduct" that blocks competition. J&J says it simply offered rebate options health plans requested.

In October, biosimilar versions of the world's most lucrative drug, Humira, hit Europe. Humira, which treats psoriasis, rheumatoid arthritis and other autoimmune disorders, launched 17 years ago and brought maker AbbVie $20 billion in 2018 sales, two-thirds from the U.S.

Seven drugmakers have Humira biosimilars approved or awaiting approval in the U.S., but none are expected soon. AbbVie sued each rival to block sales, claiming they would infringe Humira patents. All seven companies eventually settled, agreeing to pay AbbVie royalties so they can start selling biosimilar versions — in 2023.

Boehringer Ingelheim, the last company to settle, had alleged AbbVie "improperly created a 'patent thicket,' comprising more than a hundred overlapping and non-inventive patents, for the sole purpose of extending its monopoly far beyond the expiration of its core patent for Humira in 2016."

AbbVie wouldn't discuss Humira. But at a September conference, Chief Financial Officer William Chase said, "You've seen us execute very nicely with our legal strategy" to delay U.S. competition.

Meanwhile, AbbVie has raised Humira's U.S. monthly list price from $1,524 in 2009 to $5,174, according to figures from health data firm Elsevier.

Makers of Avastin, Herceptin, Rituxan and Enbrel likewise raised their list prices 50% to 200% over that decade.

DIM FUTURE?

Drugmakers are obligated to maximize profits for shareholders, and hiking prices in the U.S., where they make the lion's share of revenue, is a sure way of helping their bottom line.

Price experts including Dr. Peter Bach of Memorial Sloan Kettering Cancer Center in New York recently proposed scrapping biosimilars, saying they can't succeed due to biologic drugs' complexity and the nation's for-profit health care system.

They suggest that after biologic drugs have enjoyed their 12-year monopoly, their makers then sell them at cost plus a reasonable profit, set by an independent agency.

Analyst Steve Brozak, president of WBB Securities, believes it will take another recession and a surge of unemployed, uninsured patients for the government to enact major changes to boost biosimilar use.

Even if biosimilar access improves, few patients will see big savings, predicts Michael Kleinrock, research director at IQVIA. Insurers and prescription benefit managers will get those.

"Many people will still have to pay up to their deductible" or out-of-pocket maximum, he says.

Kleinrock sees bigger problems: Only about 20 biologic drugs have the billions in annual sales making it worthwhile to develop biosimilar rivals. And biosimilars of drugs created years ago will lose favor as improved, next-generation biologic medicines arrive.

"If there's less reward, there's less incentive," he says.